japan corporate tax rate 2018

Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes. S.

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Income from 9000001 to 18000000.

. The corporate tax rate in Japan for a branch is the same as for a subsidiary. Data is also available for. Corporate income tax.

55 of taxable income. For a company with capital of 100 million or less a lower. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Tax year beginning between 1 Apr 201731 Mar 2018. Tax year beginning between 1 Apr 201631 Mar 2017. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

I added value component tax rate. Note that the definition of capital surplus was amended by the 2020 Tax Reform Act from the tax law purpose to. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated.

The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Corporate - Group taxation. S. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief.

Please note that the personal exemptions shown are for directional purposes personal exemptions for filers are calculated based on employment Income Deductions which are applied based on earnings. Administrative burdens could be very large compared to large-sized business. Last reviewed - 02 March 2022.

The consumption tax rate to 10 which includes a 22 local consumption tax as well as the. Japan Corporate Tax Rate History. Special local corporate tax rate is 4142 percent which is imposed on taxable income multiplied by the standard of.

The business year is stipulated by the companys articles of incorporation. Central government tax 3 190 255 255. The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021.

Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. But if the company is Medium and small sized company the taxable income limitation does not apply. Japan Corporate Tax Rate table by year historic and current data.

227 rows Improving Lives Through Smart Tax Policy. Overview of the Consumption Tax System in Japan - May 2018 Yasutaka Nishikori Nishimura Asahi 1 Historical Background. This booklet is intended to provide a general overview of the taxation system in Japan.

60 of taxable income. The new regime will be effective for tax years beginning on or after 1 April 2022. Japan Corporate Tax Rate by Year.

The 2020 Tax Reform Act reviewed the requirements for reporting of overseas property. A 19 corporate tax rate is applied for companies which had average incomes larger than 15 billion JPY in the preceding 3 years. S.

Corporation tax national Local corporate Tax. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen. Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation.

Historical corporate tax rate data. 0375 of capital plus capital surplus 625 of income x 12. Income from 18000001 to 400000000.

After April 1 2019. Size-based business tax consists of two components. Tax rates The tax rate is 232.

The penalty is imposed at 5 to 10 once the tax audit notice is received. Taxable income 4 mln 8 mln 4 mln 8 mln. Income from 400000001 and above.

National Income Tax Rates. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. The contents reflect the information available up to.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544. Share Date Value Value. However the tax rate increase has created a.

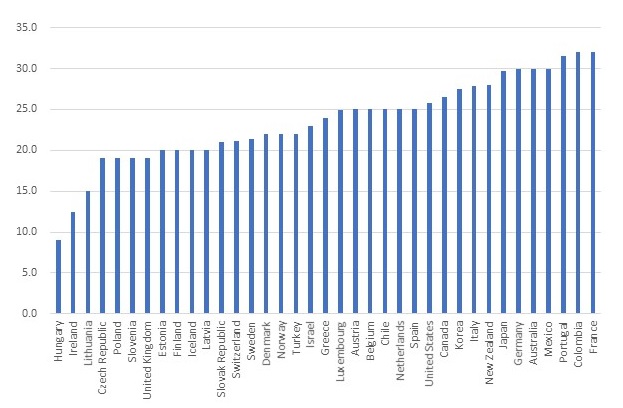

025 of capital plus capital surplus 25 of income x 14. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Taxation in Japan Preface.

Current Japan Corporate Tax Rate is 4740. Tax year beginning after 1 Apr 2018. And 31 March 2018 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

A Look at the Markets. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. In addition interest for the late payment of tax is levied at 26 per annum for the first two months and increases to 89 per annum thereafter for the year 2020.

From 12 to 144. Will the Recent Inflation Signal a Rate Hike. The main types of corporate income tax in Japan are as follows.

In addition the tax credit limitation for certain RD venture corporations ie. Labor costs net interest payment net rent payment and current year income. Corporate inhabitants tax - Prefectural standard 4 08 13 13.

50 of taxable income. Donation made to designated public purpose companies. Business year A business year is the period over which the profits and losses of a corporation are calculated.

10 Year Treasury Rate. Corporations established in the past ten years or less with carryforward losses and that are not a subsidiary of a large corporation is 40 of the corporate tax liability while the rate of 25 is. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Income from sources in Japan during each business year.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

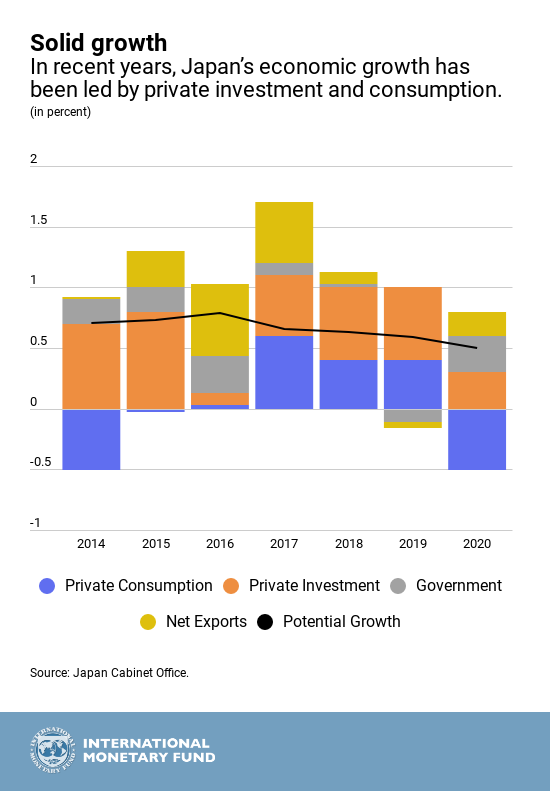

Japan S Economy In 5 Charts World Economic Forum

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Tutor2u Japanese Economy Abenomics

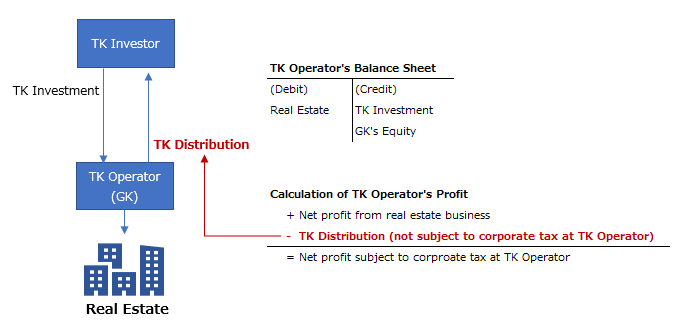

Taxation Of Tokumei Kumiai Investment Suga Professional Tax Services

Capital Gains Tax Japan Property Central

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Doing Business In The United States Federal Tax Issues Pwc

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Real Estate Related Taxes And Fees In Japan

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

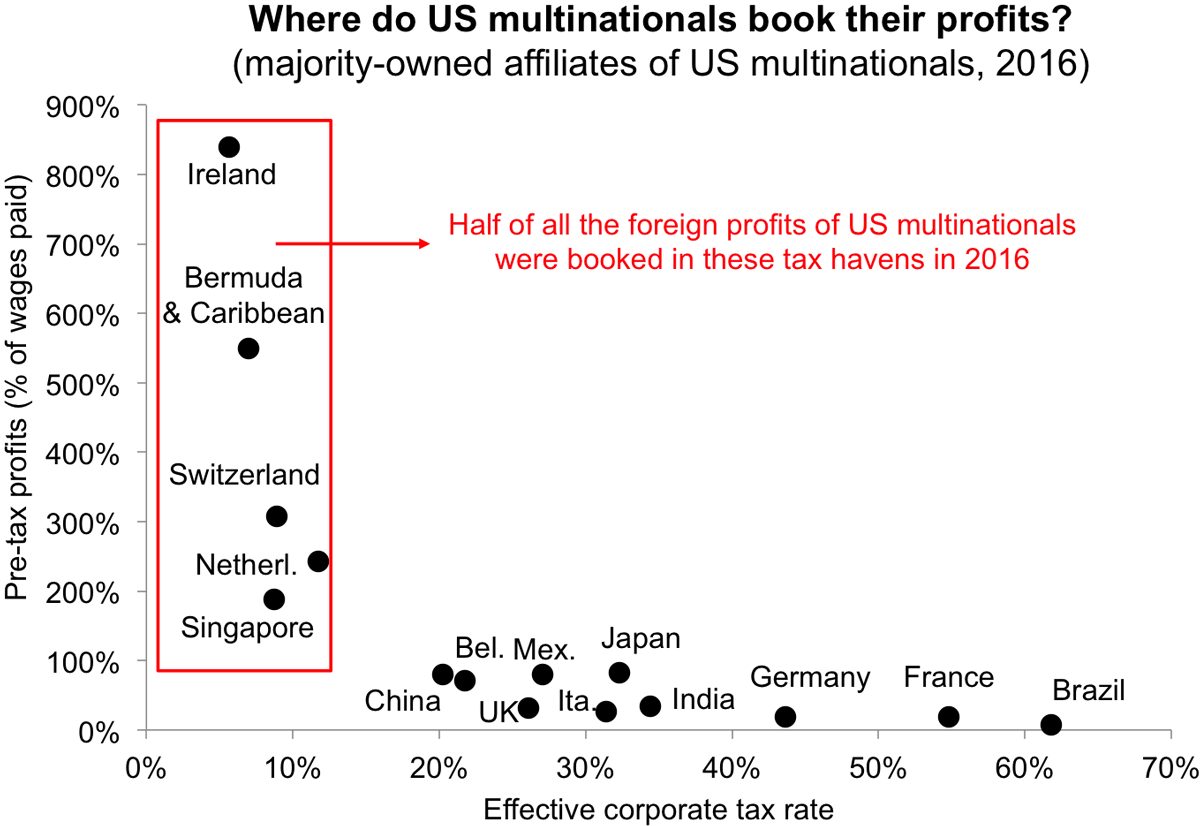

Taxing Multinational Corporations In The 21st Century Economics For Inclusive Prosperity

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation